The Stakeholders in Blockchain Technology Association of Nigeria (SiBAN) recently joined forces with the Central Bank of Nigeria (CBN) and the Federal Inland Revenue Service (FIRS) in a high-level engagement to shape Nigeria’s evolving regulatory framework for virtual assets.

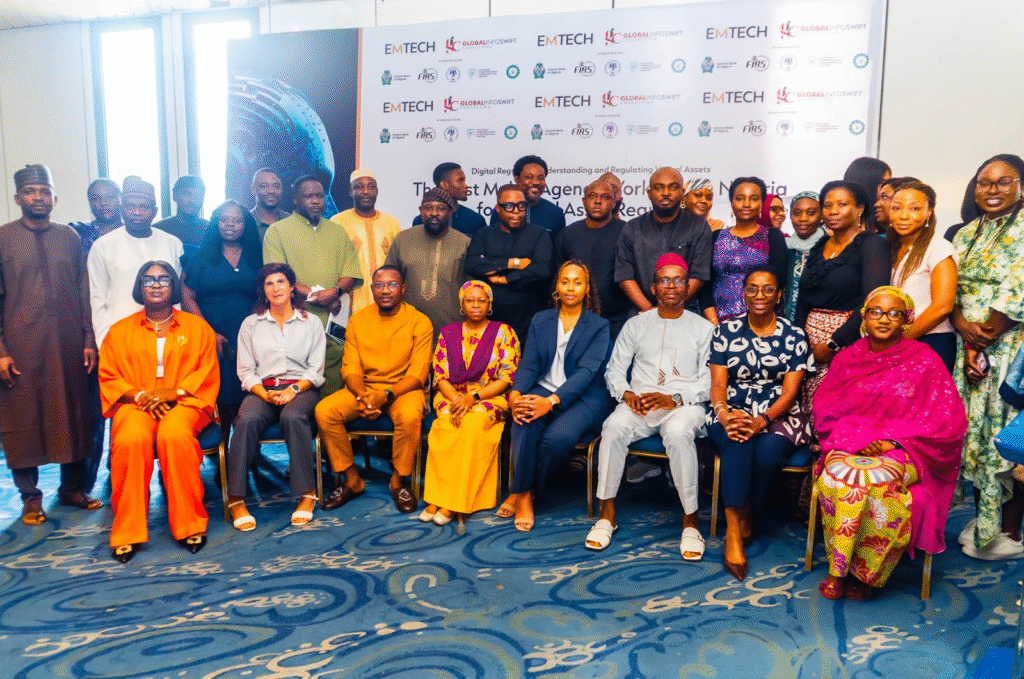

The collaboration took place at a two-day workshop held at the Transcorp Hilton, Abuja, hosted by Emtech in partnership with GlS themed “Digital Regulator: Understanding and Regulating Virtual Assets,” the event brought together key policymakers, regulators, and market operators for a focused dialogue on the future of virtual assets and cross sector collaboration in Nigeria. Participants included the Securities and Exchange Commission (SEC), the Office of the National Security Adviser (ONSA), the National Office for Technology Acquisition and Promotion (NOTAP), National Cybersecurity Coordination Centre (NCCC), and leading Virtual Asset Service Providers (VASPs) such as KOINKOIN Global Network Ltd and Juicyway.

Nigeria’s Evolving VASP Landscape

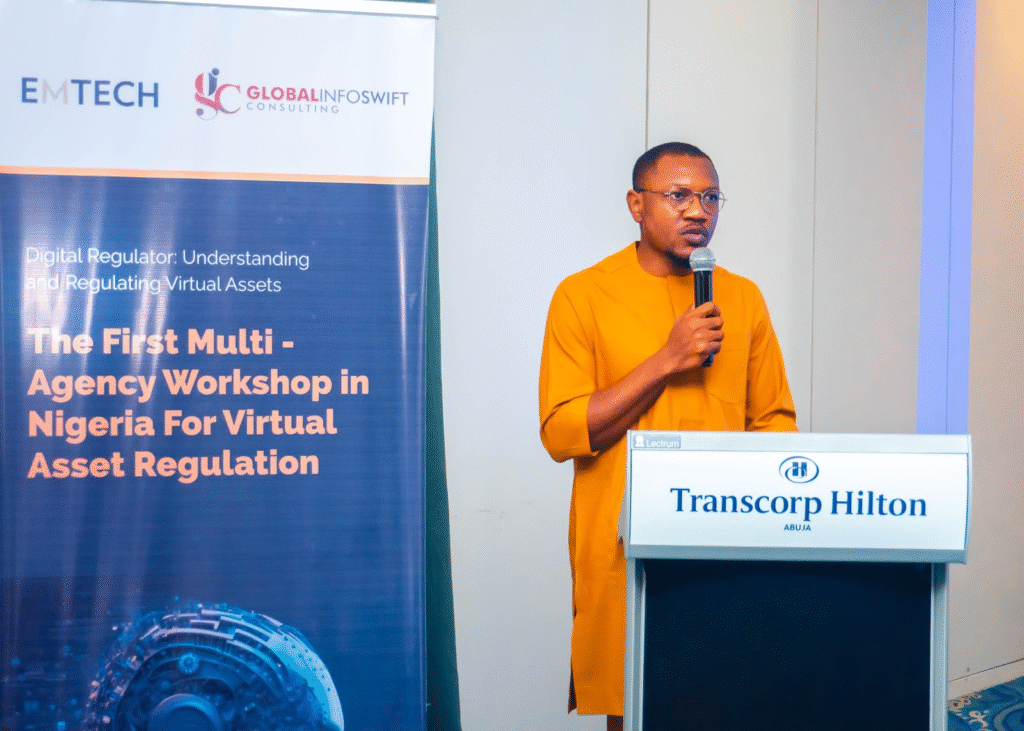

Delivering a keynote presentation titled “The VASP Landscape in Nigeria vs. The World: Current Realities, Global Standards, Challenges & Way Forward,”

SiBAN President, Obinna Iwuno provided a detailed overview of the country’s regulatory journey.

- Current Position: “Nigeria has moved from a “grey zone” to a regulated transition” Mr. Iwuno stated. He noted that existing frameworks, such as the SEC’s 2022 Rules and the CBN’s 2023 Guidelines, provide a foundation for registered VASPs, but significant challenges remain. "Thousands of other operators remain unregistered or informal, particularly within the peer-to-peer (P2P) and over-the-counter (OTC) markets, which dominate transaction volumes," he noted.

- Global Comparisons: Mr. Iwuno benchmarked Nigeria’s progress against global leaders.

The European Union’s MiCA regime, the UK’s financial promotions rules, Singapore’s Payment Services Act, Hong Kong’s stablecoin ordinance, Japan’s custody-segregation standards, the UAE’s (VARA) activity-based licenses, and South Africa’s licensing framework all provide models Nigeria can adapt to its unique market.

Delivering SiBAN’s position, Obinna Iwuno described Nigeria’s digital asset ecosystem as being at a “regulated transition” stage. He noted that foundational frameworks including the SEC’s 2022 Rules on Digital Assets and the CBN’s 2023 Guidelines for Virtual Assets represent meaningful progress but remain incomplete.

While these frameworks create a pathway for registered VASPs, Mr. Iwuno highlighted that “thousands of operators remain unregistered and operate in the informal sector, particularly within the peer-to-peer (P2P) and over-the-counter (OTC) markets.” This regulatory gap, he stressed, underscores the need for structured supervision to protect consumers and strengthen market integrity.

Key Challenges and Structural Gaps

In his remarks, Mr. Iwuno identified several persistent challenges impeding a fully regulated digital asset market:

- Regulatory Incubation: The absence of a clear pathway for firms to graduate from temporary incubation into permanent licensing.

- Banking & Payments Friction: Ongoing difficulties faced by VASPs in accessing banking and payment infrastructure.

- Stablecoin Oversight: The lack of a dedicated regulatory framework for stablecoins, currently the most widely used digital asset class in Nigeria.

- Consumer Protection & Monitoring: Limited regulatory capacity to supervise VASP activities and enforce compliance across a fragmented landscape of overlapping agency mandates.

- Taxation Uncertainty: The Finance Act (2023) and NTAA 2025 introduced capital gains tax on digital assets, but guidelines for enforcement and reporting are unclear. Creating compliance burdens and risk of double taxation.

- Fragmented Regulatory Mandates: Multiple regulators claim overlapping oversight, leading to regulatory fragmentation, delays, and uncertainty for businesses and investors.

A Roadmap for Responsible Growth

To address these challenges, Mr. Iwuno presented a phased roadmap for achieving a mature, globally aligned digital asset framework:

- Short-Term Priorities (6–12 months): Establishing a clear stablecoin regulatory framework, launching a unified public register of VASPs, and introducing a promotions code to safeguard consumers.

- Medium-Term Goals (12–24 months): Advancing regulatory incubation programs toward full authorization, deploying advanced RegTech solutions to strengthen supervision, and piloting tokenized financial assets.

- Long-Term Vision (24+ months): Achieving full compliance with international standards to position Nigeria as Africa’s leading hub for digital finance and blockchain innovation.

According to Mr. Iwuno, “By adopting global best practices, scaling supervision, and enforcing registration, Nigeria can protect consumers, increase trust and investment, and lead Africa in blockchain and virtual assets innovation.”

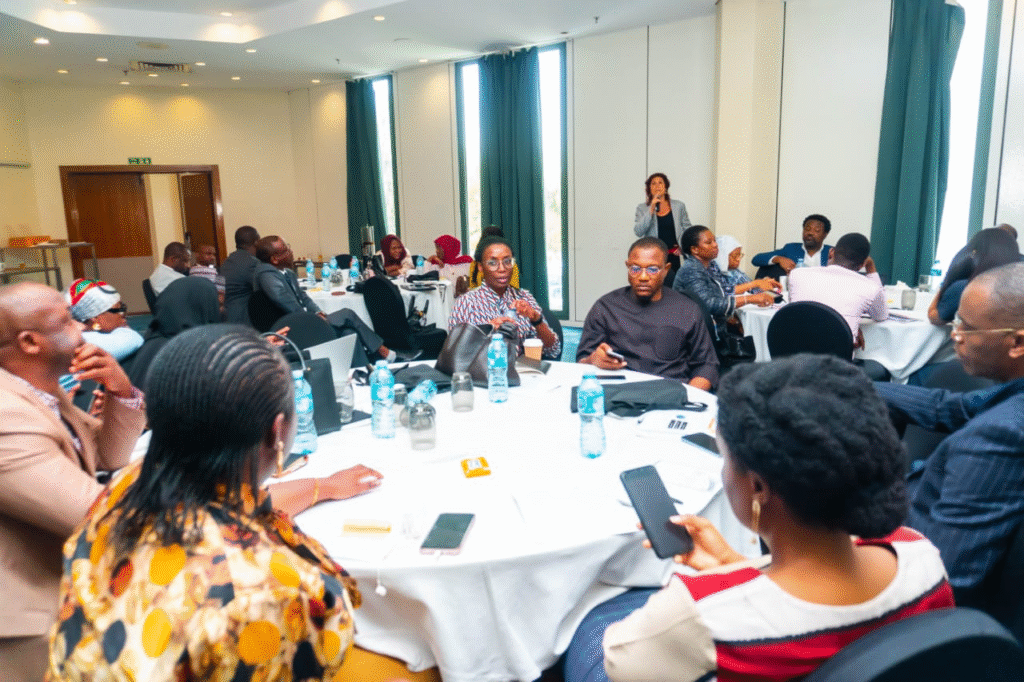

Workshop Highlights and Multi-Agency Collaboration

Over two days, participants explored tax implications, risk management, on-chain analytics, and global regulatory models.

Notable sessions included:.

- Dr. Simeon Obidairo of the FIRS explored how Nigeria’s new tax law intersects with digital assets. Discussions focused on defining taxable events, managing cross-border flows, and ensuring effective compliance.

- Carmelle Cadet from EMTECH and Jimoh Musa from CBN examined the dual nature of digital assets in Nigeria, weighing risks such as fraud against opportunities like financial inclusion and market efficiency, and also highlighted banking and payments considerations critical to market stability.

- Elise Soucie Watts (Global Digital Finance), supported by Jill Lagos Shemin and Carmelle Cadet, underscored the need for clear taxonomies and classifications to prevent fragmented regulation and regulatory arbitrage.

- Zain Umer (CFC-MENA) compared activity-based and product-based approaches, sharing lessons from Singapore and the UAE that could inform Nigeria’s evolving framework. He also provided insights from the UAE’s creation of a dedicated Virtual Assets Regulatory Authority, showing how a focused body can streamline supervision and give clarity to investors.

- Professor Tonya Evans highlighted the core compliance obligations for Virtual Asset Service Providers (VASPs), emphasizing adherence to AML/CFT protocols, KYC requirements, and FATF standards.

- Carmelle Cadet (EMTECH) demonstrated digital supervision tools such as regulatory sandboxes, followed by a live demo of the CBN Sandbox with Chai Gang, showcasing how technology can enhance real-time oversight.

- Dr. Emomotimi Agama (SEC) emphasized the importance of multi-agency collaboration in building a coherent framework.

- Afolabi Oke (GIS) stressed the need for Nigeria to meet FATF compliance standards to avoid grey listing, which could impact the country’s financial credibility and access to global markets.

- Elise Soucie Watts (Global Digital Finance),and Jill Lagos Shemin, discussed how on-chain analytics can be leveraged to detect suspicious transactions in real time and enhance market integrity.

- Panelists Ife Johnson (JuicyWay) and Ola Atose (KoinKoin) called for stronger interoperability between banks, fintechs, and blockchain operators to support a secure and scalable payment infrastructure.

These discussions reinforced the importance of collaboration between regulators, innovators, and self-regulatory bodies like SiBAN to drive compliance without stifling innovation.

The workshop represents a milestone in Nigeria’s regulatory journey, demonstrating the value of constructive engagement between government agencies and industry stakeholders. By fostering a collaborative environment, the CBN, FIRS, SEC, and other key institutions signaled their commitment to building a cohesive, transparent, and innovation-friendly framework for virtual assets.

Join SiBAN in Shaping Nigeria’s Blockchain Future

The Stakeholders in Blockchain Technology Association of Nigeria (SiBAN) is dedicated to building a safe, innovative, and inclusive blockchain ecosystem.

Industry leaders, innovators, policymakers, and the general public are invited to collaborate with us in shaping the next phase of Nigeria’s digital economy.

For SiBAN, participation in this forum reinforces its mission as Nigeria’s self-regulatory blockchain association: to bridge innovators and regulators, shape practical standards, and ensure that Nigeria’s digital asset ecosystem grows in a way that is safe, inclusive, and globally competitive.

As Nigeria moves toward a more structured regulatory environment, SiBAN will continue to advocate for policies that balance innovation with accountability, ensuring that the country not only keeps pace with global trends but sets a benchmark for blockchain governance across Africa.

Be a part of SIBAN. Contact us at membership@siban.org and join our free telegram group