The Stakeholders in Blockchain Technology Association of Nigeria (SiBAN) has issued a strong call for all industry players to actively engage in the process of lawmaking and regulation, particularly concerning the new tax provisions introduced by the Nigeria Tax Administration Act (NTAA) 2025.

This call was made during the recent X (twitter) space, “NTAA 2025 & Crypto: Navigating Digital Asset Taxation in Nigeria”, convened by SiBAN in partnership with Mariblock and Chainkeeping. The session provided a platform for dialogue between industry leaders, tax experts, and stakeholders to unpack the implications of the NTAA 2025 and the opportunities it presents.

SiBAN President: Industry Cannot Be Passive

Speaking during the session, Obinna Iwuno, President of SiBAN, emphasized the importance of industry-wide involvement.

“You cannot be in an industry and be non-chalant about the industry, you would end up becoming a victim of your own hard work,” he warned.

He explained that while innovation often begins in unregulated spaces, it must eventually align with regulation. However, regulators are not always pro-innovation, which is why industry actors must proactively engage with government and policymakers to ensure a balanced, ethical, and growth-supportive regulatory framework.

Iwuno further stressed the sector’s vast economic potential, noting that the digital asset industry has the capacity to contribute billions of dollars in revenue and attract significant investment to Nigeria.

Why NTAA 2025 Matters

For the first time in Nigeria’s history, virtual assets and cryptocurrency activities, including airdrops and bounties, have been explicitly recognized as taxable items under the NTAA 2025. This new reality makes industry awareness and compliance paramount, and was a key reason behind convening the educational series. The session featured insightful contributions from experts and practitioners.

Opening the conversation, Omotola Dorcas, Head of Marketing at Mariblock, who served as the moderator, emphasized the urgent need for stakeholders to approach the new tax and compliance environment with a proactive mindset. She explained that the purpose of the dialogue was to unpack the realities of NTAA 2025, noting that “digital assets are here to stay, no doubt, but the rules are evolving from taxation to AML and KYC obligations. Stakeholders must be proactive and not reactive, which is why we'll always be committed to having conversations like this.”

Adding a legal perspective, Chiemaka Ohajionu, Partner at Atlas Legal Practitioner, highlighted that the introduction of digital asset taxation represents progress rather than regression. Reflecting on the journey from the 2021 ban on crypto activities to the present, Ohajionu stressed that the establishment of these laws is “a very good thing for the space.” He urged stakeholders to engage the law constructively: “Any criticism that is coming in respect to the tax law should come from a position of knowledge. You need to take your time to look at what the laws are saying, and then if you have any criticism against what the law is saying, then you criticize from the point of informed knowledge, not outright rage or ignorance.”

From an accounting perspective, Winner Mugana, a Chartered Accountant and Blockchain Accountant, broke down the practical implications of the NTAA 2025. She noted that the Act has “majorly two purposes: the first is to facilitate tax compliance... and the second purpose is to optimize tax revenue for the country.” According to her, everyone operating within the crypto space, whether buying, selling, or trading, is directly affected. HShe further emphasized the law’s requirements: “The Tax Act outlines two major mandatory requirements for us in this space as taxpayers: the first is that each and every one has to ascertain a Tax Identification Number (TIN) and the second mandatory requirement is for every company to designate a representative that will attend to their tax matters.”

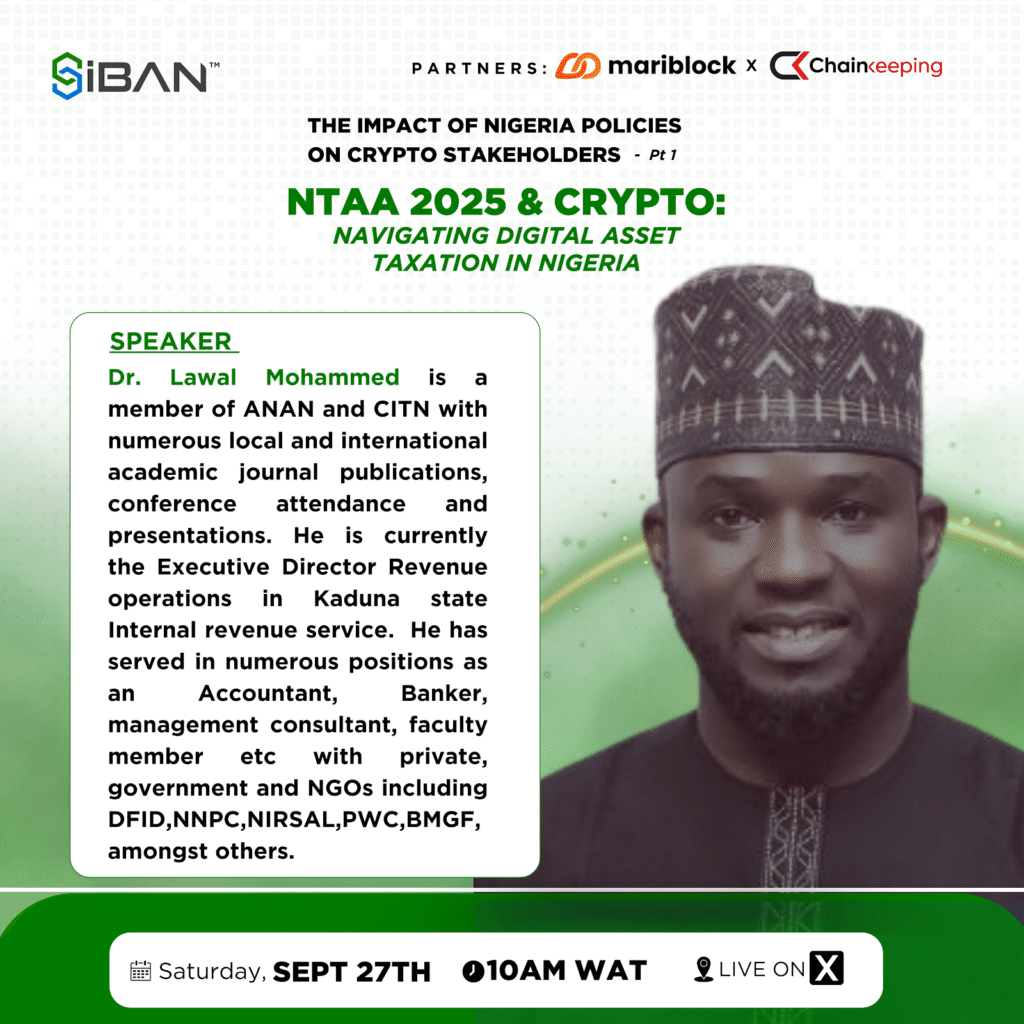

Bringing in a policy and regulatory perspective, Dr. Lawal Mohammed, Executive Director of Revenue Operations at Kaduna State IRS, traced the reforms within the larger historical context of Nigeria’s tax system. He argued that NTAA 2025 should be seen as part of a much-needed reform process, explaining that “Nigeria has had a long history with taxation, and if you are aware, you will understand perfectly well why we need these reforms, and then, indeed, why we need to all go back to that space and ensure that this reform works.” He pointed out that Nigeria has consistently recorded one of the lowest tax-to-GDP ratios globally, aside from a few exceptions such as Saudi Arabia and Dubai, underlining the urgency for reforms like NTAA 2025.

Together, the panelists painted a comprehensive picture: NTAA 2025 represents both a challenge and an opportunity, a chance to formalize and legitimize digital assets within Nigeria’s economic framework while requiring all industry players to adapt, comply, and participate actively in shaping the outcome.

During the session, Mr. Olayimika Oyebanji, a participant in the space, raised a counter perspective on the ongoing tax discourse. He argued that many people within the ecosystem are still unaware of the applicable tax rates and structures, and more importantly, that the current regime does not provide crypto-specific incentives that could encourage compliance. “We should be asking if these taxes are fair or reasonable,” he noted, stressing that a framework built on voluntary compliance is far more effective than one rooted in enforcement. According to him, paying less is not necessarily an incentive; what matters is whether the regime offers tangible benefits that encourage taxpayers to willingly come forward.

Olayimika further questioned whether the NTAA 2025 framework has been designed with incentives that will genuinely promote compliance, especially given the general reluctance among many to pay. “It is not by policing,” he emphasized, adding that taxing an industry that still lacks formal recognition raises deeper concerns about fairness and acceptance.

This contribution underscored the fact that the conversation was far from one-sided. While some viewed the NTAA 2025 tax provisions as a sign of progress toward legitimacy and regulatory clarity, others highlighted the gaps, questioning fairness and the absence of incentives. Ultimately, the exchange revealed that stakeholders across the ecosystem see the tax regime from different angles, balancing optimism about regulatory recognition with concerns about practicality, fairness, and long-term industry growth.

Listen to the full recording of this timely conversation here

Time to take action

SiBAN has reiterated its commitment to advocacy, education, and engagement with both regulators and innovators. The Association is inviting professionals, operators, builders, investors, and funders to join its efforts in shaping Nigeria’s digital asset future.

By working collaboratively, the industry can ensure that taxation and regulation become tools for sustainable growth, not barriers to innovation.

For updates, resources, and opportunities to contribute, join SiBAN’s membership community at membership@siban.org and connect with peers via our free Telegram group.